Started By

Message

Arch should transfer to Memphis or Ole Miss as the 3rd or 4th string qb.

Posted on 10/9/25 at 5:17 am

Posted on 10/9/25 at 5:17 am

If he does not make it at Memphis he could dye his hair black and go to work at Graceland doing some Elvis singing and dancing.

I think being a back up at Ole Miss is his best option if the Elvis thing does not work out. At Ole Miss he can talk to the older booster about who his grandpa is etc.

He may also see if some state association would grant him a few more years eligibility and return to a good high school and learn to play qb.

I think being a back up at Ole Miss is his best option if the Elvis thing does not work out. At Ole Miss he can talk to the older booster about who his grandpa is etc.

He may also see if some state association would grant him a few more years eligibility and return to a good high school and learn to play qb.

Posted on 10/9/25 at 6:41 am to TheFourHorsemen

quote:

I think being a back up at Ole Miss is his best option if the Elvis thing does not work out. At Ole Miss he can talk to the older booster about who his grandpa is etc.

Posted on 10/9/25 at 7:53 am to TheFourHorsemen

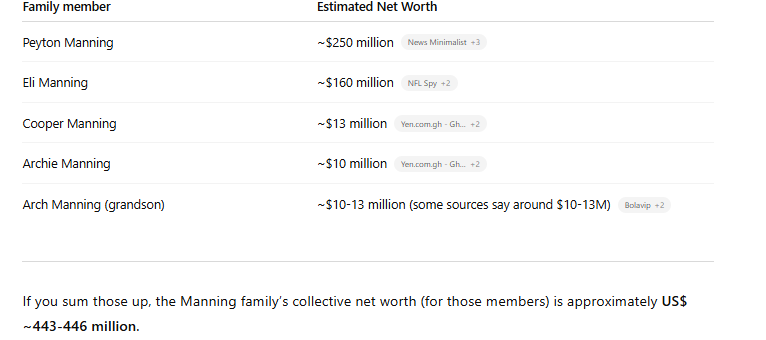

Arch will be able to buy Ole Miss before he leaves Texas.

Posted on 10/9/25 at 8:00 am to MtVernon

quote:

Arch will be able to buy Ole Miss before he leaves Texas.

And this is why Texas will never be back...

Posted on 10/9/25 at 9:25 am to reggierayreb

I must make a point here. The gif below is what makes Texas SEC worthy. Except for Vandy - I could see this happening with any SEC kid. (and many grown-ups)

Could you see a kid crying with a Northwestern, UCLA, or Rutgers hat on? This is why the Big Ten sucks.

Could you see a kid crying with a Northwestern, UCLA, or Rutgers hat on? This is why the Big Ten sucks.

Posted on 10/9/25 at 9:36 am to MtVernon

quote:This isn’t the flex you think it is

Arch will be able to buy Ole Miss before he leaves Texas.

Posted on 10/9/25 at 9:42 am to MtVernon

quote:

Arch will be able to buy Ole Miss before he leaves Texas.

He is going to be worth billions $?

You say a ton of stupid shite, but hell let us play along.

Prompt

quote:

How much is Ole Miss worth? To buy it all, hypothetically speaking

quote:

Here’s a transparent, back-of-the-envelope way to answer “What would it cost to buy all of Ole Miss (hypothetically)?” I’ll break it into the major pieces you’d be trying to acquire and use publicly reported figures, then apply reasonable valuation haircuts/uplifts where the assets are restricted or historically costed.

Important caveat: Ole Miss is a public institution; many assets (especially endowment gifts) are donor-restricted and/or legally nontransferable. So this is an illustrative valuation, not something a court or banker would accept.

What you’d be “buying,” in broad strokes

The university’s physical plant and land (Oxford + other sites), including academic buildings, residence halls, libraries, etc. The Oxford campus and affiliated tracts total ~2,500+ acres (about 1,200 acres for the core campus plus ~1,300 acres for airport, golf course, field station, etc.). [catalog.olemiss.edu]

UMMC (University of Mississippi Medical Center)—an academic health system in Jackson with ~$1.9B of authorized FY25 operating funds (general fund + special funds). [billstatus...tate.ms.us]

Athletics (facilities, media revenues, SEC revenue share, brand). In FY24, Ole Miss Athletics reported $149.3M operating revenue and $157.0M expenses (a ~$7.7M deficit). The SEC distributed ~$52.5M per full-share school for FY2023-24. [olemisssports.com], [www.clario...ledger.com] [www.secsports.com]

The philanthropic endowment/foundations. The UM Foundation reported $787.0M net assets as of June 30, 2024, and Ole Miss announced the endowment surpassed $1B in June 2025 after a record fundraising year. The “Now & Ever” capital campaign also totaled $1.75B by Sept. 2025 (donations/pledges). (Note: Most funds are donor-restricted to specific purposes.) [www.umfoundation.com], [olemiss.edu], [magnoliatribune.com]

Step 1 — Asset-based “floor” (book values, then adjust to market)

A. Physical plant & land (core university)

From audited IHL statements, the University of Mississippi shows Net investment in capital assets ˜ $3.68B (6/30/2024). Book values understate current replacement cost, because they’re at historical cost less depreciation. [www.mississippi.edu]

A sanity check on current build costs: the new Duff Center for Science & Technology (opened 2024) is ~202k GSF with an all-in cost of $175.2M (˜ $865/GSF), highlighting how replacement costs have escalated. If we uplift the $3.68B net book by ~30–60% to approximate modern replacement cost, we get ~$4.8B–$5.9B for the physical plant/land bundle. [www.mississippi.edu]

B. Endowment/foundation assets

UM Foundation net assets (6/30/2024): $787M; Ole Miss notes the endowment > $1B as of June 2025. Because most endowment dollars are legally donor-restricted, a control buyer can’t freely redeploy them; a conservative purchase model would haircut by ~40–60% to reflect legal restrictions and spend-rate limits. That puts the transferable/control value at ~$0.4B–$0.6B. [www.umfoundation.com], [olemiss.edu]

Asset-based subtotal (core campus + endowment control value): ~$5.2B–$6.5B.

Step 2 — Income/value of the medical center (UMMC)

FY25 appropriations/authorizations show $193.8M from the general fund and $1.719B in special funds (patient revenue and other sources) for UMMC, i.e., ~$1.9B of operating funds. Nonprofit hospital transactions often price conservatively (tight margins and high capex needs), so applying a 0.6×–1.0× revenue multiple gives a rough enterprise value of ~$1.1B–$1.9B. (Sector medians show thin operating margins and a still-uneven recovery, which is why I use modest multiples.) [billstatus...tate.ms.us], [www.hfma.org], [www.kaufmanhall.com]

UMMC add-on: ~$1.1B–$1.9B.

Step 3 — Athletics & SEC membership value

Reported FY24 athletics revenue: $149.3M (NCAA report). The SEC paid ~$52.5M per full member in FY2023-24. [olemisssports.com], [www.secsports.com]

What’s “buyable”? Facilities roll into the physical plant above. The intangible is the media/brand/SEC share. Pro/club teams often trade at revenue multiples, but college athletics are non-profit and tethered to the university. A pragmatic approach is to ascribe 0.5×–1.0× athletics revenue for the brand/contract rights, then discount for non-transferability and governance risk, or equivalently, to value a portion of the SEC share as an annuity with a large haircut.

Putting that together yields an intangible athletics value of roughly $0.3B–$0.5B (i.e., $150M revenue × 0.5–1.0, then haircut/round for non-transferability; or a heavily hair-cut PV of the SEC distribution stream). [olemisssports.com], [www.secsports.com]

Athletics add-on: ~$0.3B–$0.5B.

Step 4 — Put the pieces together

Physical plant & land (replacement-cost adjusted): ~$4.8B–$5.9B [www.mississippi.edu], [www.mississippi.edu]

Endowment/control value (restricted haircut): ~$0.4B–$0.6B [www.umfoundation.com], [olemiss.edu]

UMMC (EV/Revenue 0.6×–1.0×): ~$1.1B–$1.9B [billstatus...tate.ms.us], [www.hfma.org], [www.kaufmanhall.com]

Athletics brand/SEC rights (intangible): ~$0.3B–$0.5B [olemisssports.com], [www.secsports.com]

Hypothetical “buy-it-all” value (range): ~$6.6B – $8.9B

Round it and you can think of Ole Miss as a $6½–$9B institution on a hypothetical control basis.

Cross-checks (why this isn’t crazy)

The book “net position” on the university’s audited statements (which bakes in historical-cost depreciation and excludes the foundation) is ~$2.91B—a reasonable floor that rises a lot once you step up to replacement-cost for facilities and include the medical center. [www.mississippi.edu]

Recent capital projects and bond approvals (e.g., $245M in 2024 for housing and women’s athletics facilities) show the current cost of adding capacity—consistent with a multi-billion replacement value for the footprint. [govmarketnews.com]

The endowment surpassed $1B in 2025 and the $1.75B campaign underscore the philanthropic asset base—but again, most of that is restricted, which is why I discounted it for control value. [olemiss.edu], [magnoliatribune.com]

Sensitivities you might want to tweak

Scope: If you exclude UMMC, subtract ~$1.1–$1.9B. If you only want the Oxford campus assets and athletics brand, you’re likely in the ~$5.5–$7.5B zone. [billstatus...tate.ms.us]

Facilities uplift: Using a higher or lower replacement-cost uplift (e.g., +20% vs. +60% to book) moves the total by hundreds of millions quickly. The Duff Center cost provides one current benchmark. [www.mississippi.edu]

Athletics/SEC valuation: You can be more aggressive (capitalize a larger share of the SEC revenue stream) or more conservative (treat it as entirely non-transferable). The $52.5M/year distribution is the anchor. [www.secsports.com]

TL;DR

If a (purely hypothetical) buyer wrote a single check to control Ole Miss (university + UMMC + athletics + foundations), a defensible range is $6.6B to $8.9B given the physical plant’s replacement value, the medical center’s revenue base, the SEC media economics, and the restricted nature of endowment assets. [www.mississippi.edu], [www.mississippi.edu], [billstatus...tate.ms.us], [www.hfma.org], [www.kaufmanhall.com], [www.secsports.com], [olemisssports.com], [www.umfoundation.com], [olemiss.edu]

Posted on 10/9/25 at 9:45 am to DarthRebel

Well, according to a recent release, our endowment jumped up to $1.75 billion.

Posted on 10/9/25 at 11:45 am to DarthRebel

quote:

You say a ton of stupid shite

You should have stopped there. This is tRant. I was saying stupid shite.

Albeit to make a point that Arch won't be leaving Texas without a nickel or two.

Posted on 10/9/25 at 12:08 pm to Insurancerebel

Living your life through a game is childish

Posted on 10/9/25 at 12:54 pm to MtVernon

quote:

Could you see a kid crying with a Northwestern, UCLA, or Rutgers hat on? This is why the Big Ten sucks.

Posted on 10/9/25 at 12:57 pm to cbi8

Basketball. I stand corrected.

Popular

Back to top

2

2