Pintail

| Favorite team: | LSU |

| Location: | |

| Biography: | |

| Interests: | |

| Occupation: | |

| Number of Posts: | 11961 |

| Registered on: | 11/15/2011 |

| Online Status: | Not Online |

Recent Posts

Message

Home plate ump almost Karate chopped the catcher with the safe call :rotflmao:

quote:

Agree, and not even a discussion

Very short memory here. Last years show will forever be in the conversation of worst performance of all time.

re: Why doesn’t men’s bball have a game this week?

Posted by Pintail on 2/5/26 at 9:03 pm to HailHailtoMichigan!

.500 week ain’t nothing to be mad about

quote:

D1baseball.com: This will be used for the games in Jacksonville Feb 20-22. You’ll need a subscription to d1baseball.com that includes streaming. There are many monthly/annual options with various extras. (More specific info coming later)

What fools are going to get duped by them again?

quote:

Correct, however we have the right to protest anything we may find unjust…that right is protected under the first amendment.

Peaceful assembly is protected under the first amendment.

Keyword here being peaceful.

But the whole first amendment is skewed anyway so what does that matter.

re: Monarch Money Management

Posted by Pintail on 1/26/26 at 3:20 pm to Roy Curado

quote:

Anyone use Monarch

I use it. Besides having to pay for it, it was a good replacement for Mint

re: The 30 wealthiest neighborhoods in Louisiana

Posted by Pintail on 1/26/26 at 2:45 pm to Jim Rockford

quote:

The Bluffs in Baton Rouge stands as one of Louisiana’s most prestigious neighborhoods, offering residents an exclusive golfing community experience.

Is someone going to tell them?

re: EBR Schools closed Monday, Jan 26

Posted by Pintail on 1/24/26 at 7:46 am to PaintCompany

quote:

To all the know it all folks, I’m a former supervisor in a local school system, and we spent many a Sunday going over all variables with the superintendent prior to hurricanes, winter weather, or possible tornadic weather. There’s much more to making that decision besides just having a day off.

I would love to hear the reasons why there cannot be a plan of action that can be activated on a Sunday rather than Friday.

Hell send an update Friday and say he parent we are monitoring the weather situation and will provide updates through the weekend. There is a potential for schools to be closed Monday so we asked teachers and staff to plan accordingly.

I got a similar update from Delta Utilities and Entergy the last couple days.

re: EBR Schools closed Monday, Jan 26

Posted by Pintail on 1/23/26 at 2:11 pm to GreenRockTiger

quote:

today is Friday - you mean wait until Sunday when no one is at work at EBR schools?

You are goddamn right. Doesn’t stop my office from having a daily update call through the weekend to see what Monday holds.

quote:

I'm assuming you think the kids should go to school Monday? What's the worst that happens? The kids get a day off of school? I can think of much worst possibilities if they don't close schools.

Or idk wait a couple days to make the damn call.

re: BPB baseball January 21st

Posted by Pintail on 1/21/26 at 9:06 pm to Classy Doge

quote:

Tomorrow 3:30 pm Friday 3:00 pm Saturday 1:00 pm

Yes but in years past the last scrimmage before the season there is a poster signing. Trying to figure out if that is this weekend.

re: BPB baseball January 21st

Posted by Pintail on 1/21/26 at 8:57 pm to Classy Doge

Is this the only weekend of scrimmages or will there be more?

re: My peanut butter rant

Posted by Pintail on 1/20/26 at 3:12 pm to BluegrassBelle

Made my after I bought too many cans of planters peanuts on sale. Now the kids love making it and it taste better than any peanut butter on the shelf. (maybe not Jif natural). It is easy as can be.

1 can dry roasted salted peanuts

2 tbsp honey or just add until it is as sweet as you like

Put it in a food processor until it is the consistency you want. :dude:

1 can dry roasted salted peanuts

2 tbsp honey or just add until it is as sweet as you like

Put it in a food processor until it is the consistency you want. :dude:

quote:

More walking around not called travelling

5 steps lol

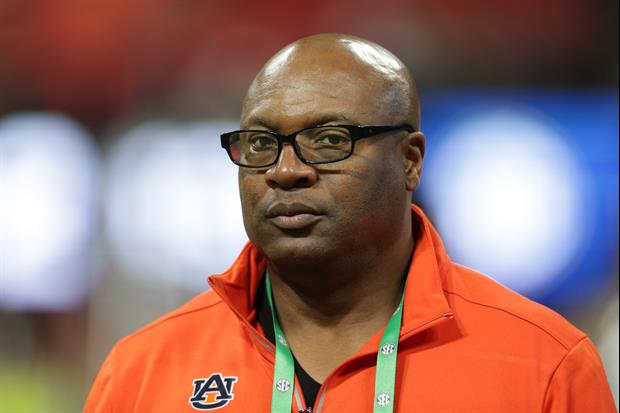

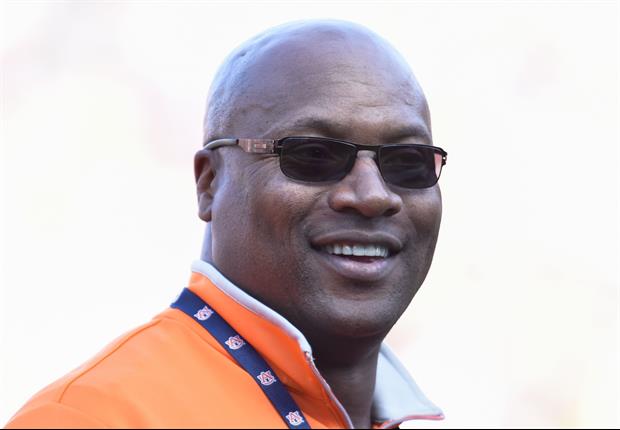

re: Although I do want McMahon fired, I do feel for him

Posted by Pintail on 1/14/26 at 8:37 pm to latigerfan2

quote:

The program was winning until he took it over and drove it off a cliff

I don’t like the way the program is going but let’s not pretend he wasn’t set up to fail. I don’t remember the number but pretty sure we lost everyone after Wade was fired

re: Tyrann Mathieu on pay then vs now: “I've had my fair share of $10,000–$20,000 handshakes”

Posted by Pintail on 1/13/26 at 2:51 pm to DaleGribblesMower

quote:

His path, idiot? You know that whole team was a bunch of degenerate drunkards and you all laugh at their stories on podcasts now, idiot. So again, idiot, he smoked some weed. Big fricking deal, idiot

I mean you don’t have to take my word for it..or you could just keep doubling down.

ESPN article with TM7 Own words

re: Tyrann Mathieu on pay then vs now: “I've had my fair share of $10,000–$20,000 handshakes”

Posted by Pintail on 1/12/26 at 9:42 pm to DaleGribblesMower

quote:

You don’t die from weed, idiot

Well don’t take my word for it. Idiot.

Weed wasn’t going to kill him, but his path was not the life he wanted.

re: Whoa, this is what happens when Soy Boys pick the wrong person to make a statement.

Posted by Pintail on 1/12/26 at 9:31 pm to Seth Bullock

quote:

Instigator in the red jacket got that 2-piece.....

GIF needed asap

re: Tyrann Mathieu on pay then vs now: “I've had my fair share of $10,000–$20,000 handshakes”

Posted by Pintail on 1/12/26 at 9:15 pm to AaronDeTiger

quote:

Possibly saved Mathieu's life

FIFY

I had them at my last house. Tried everything from poison, traps, and sticking a hose in the hole running water in it. Nothing worked. Ended up moving so it was the new owners problem.

They have now infiltrated my new yard and I am fighting them again.

They have now infiltrated my new yard and I am fighting them again.

quote:

I think they used a lot of AI but it was pretty impressive how fast they came out with that video.

UNITED SATAES on the map at 4:19 lol. Yes it is AI generated.

Popular

1

1