Jakesonaplane

| Favorite team: | LSU |

| Location: | Denver |

| Biography: | |

| Interests: | |

| Occupation: | |

| Number of Posts: | 7281 |

| Registered on: | 11/1/2010 |

| Online Status: | Not Online |

Recent Posts

Message

re: Was Brad Davis that bad?

Posted by Jakesonaplane on 1/6/26 at 12:34 pm to Team Purple

Those schools bought the hype, high school stars, and the hope of their potential with a different O-Line coach. They certainly didn’t pick them up based on their on-field performance last year

re: Clemson DL Stephiylan Green Commits to LSU!!!

Posted by Jakesonaplane on 1/6/26 at 12:23 pm to Tank77

Happy about the commitment but that might be the worst photoshop job I’ve ever seen. It’s 2026

re: So.....how bout that O-line?

Posted by Jakesonaplane on 1/6/26 at 7:44 am to RaginRed

quote:

Does the staff not know that almost the entire 2deep offensive line is gone?

You say that like it’s a bad thing

re: See The LSU Recruiting Board For The Latest Transfer Portal News

Posted by Jakesonaplane on 1/4/26 at 9:32 pm to Mitreman

Looks like Sorsby signed with Texas Tech. Pussy remains undefeated

re: Van Buren enters portal

Posted by Jakesonaplane on 1/3/26 at 4:49 pm to Prairievillian

Death, taxes, and Van Buren never starting for LSU again. Only certainties in life

re: Curt Cignetti grew up in a town that has produced 18 NCs within a 30-mile radius

Posted by Jakesonaplane on 1/3/26 at 12:47 am to LSUtiger89

quote:

No 2011 at West Virginia

I remember some local redneck at a bar outside of town telling me not to mess with the local WV fans. He said something like “A you’re outnumbered and B not only is getting arrested not a big deal to these people, it’s a bi-weekly occurrence”

That was the weekend a WV threw a rock through the windshield and broke some guys orbital bone and also hit a pregnant lady

re: Waitlist at Casa Bonita is pretty long

Posted by Jakesonaplane on 12/27/25 at 4:40 pm to ob1pimpbobi

You can snag reservations day-of. People get on the waitlist and forget about it so there are tons of cancellations. I’ve done it twice in the last few months when we have friends in town.

re: OK Tiger fans, who's pulling for Tulane or Ole Miss?

Posted by Jakesonaplane on 12/20/25 at 2:53 pm to Louisianalabguy

Roll MF Wave today

re: Anyone have any cool Scotty Cameron's?

Posted by Jakesonaplane on 12/17/25 at 7:24 pm to YieldDawg

re: Alabama Hate for Kiffin

Posted by Jakesonaplane on 12/7/25 at 5:02 pm to Missouri Waltz

It’s a lateral move to pretty much any college from here on out. I think he wants a Saban-like legacy and he can do that here. At Alabama, whatever he does will always just be a comparison to Saban’s tenure. Also what advantages would Alabama offer that LSU wouldn’t?

re: Really disappointed that Campbell didn’t stay and build something great right there at ISU

Posted by Jakesonaplane on 12/6/25 at 10:08 am to DaleGribblesMower

Kinda like Jim Mora Jr. not staying at UConn and building a powerhouse there :lol:

re: Any teams y’all are pulling for this year in the playoffs?

Posted by Jakesonaplane on 12/5/25 at 2:50 pm to SelaTiger

Indiana. They might be good but I highly doubt anyone really expects them to go all the way. It will still feel like a Cinderella story. Let’s see a basketball school win it all

re: Is LSU now the "villain?"

Posted by Jakesonaplane on 12/2/25 at 12:07 pm to linewar

I hope so. Time to take our place at the top, win multiple championships and have other teams fans tired of us wining all the time.

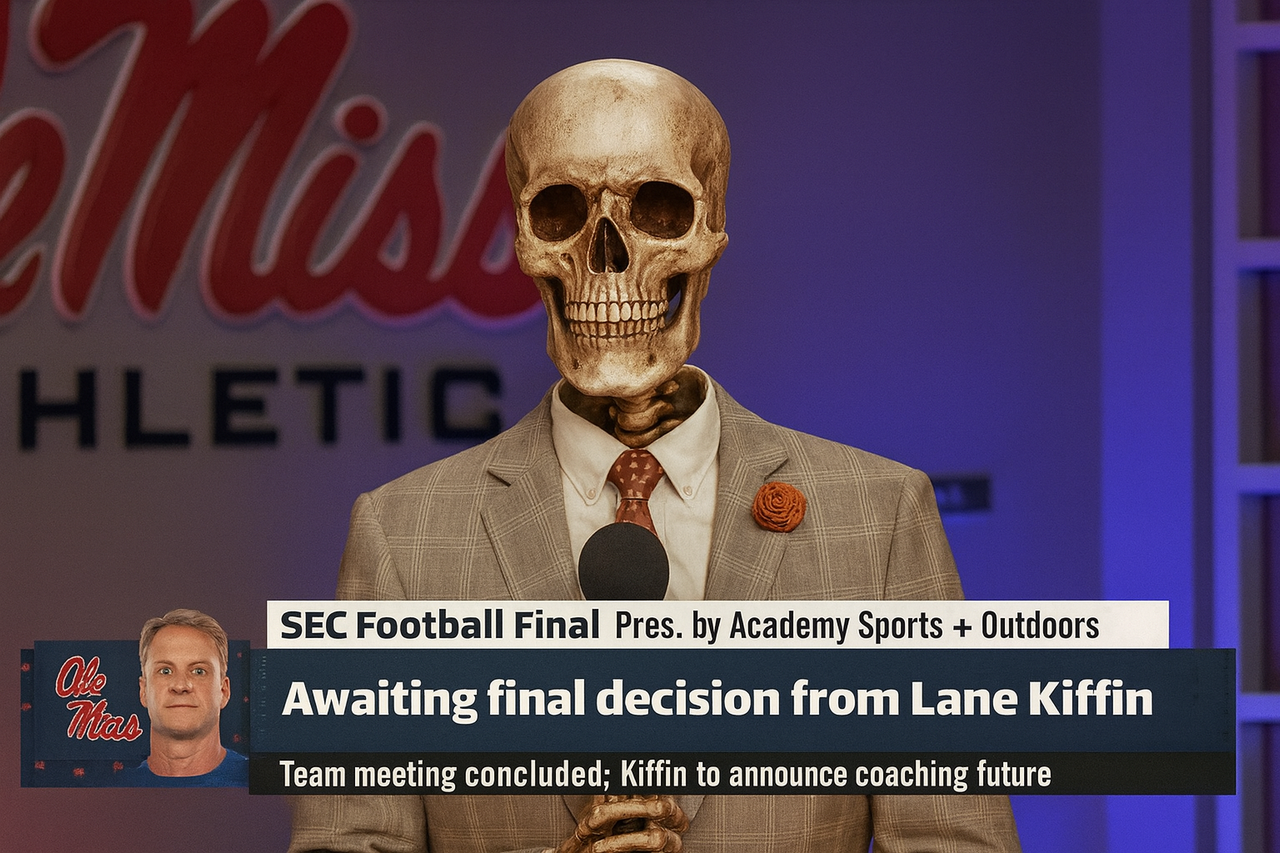

re: One of the greatest gifts this coaching cycle gave...

Posted by Jakesonaplane on 12/1/25 at 2:14 pm to TigerLunatik

I made this one to finish out the progression. RIP in peace Marty

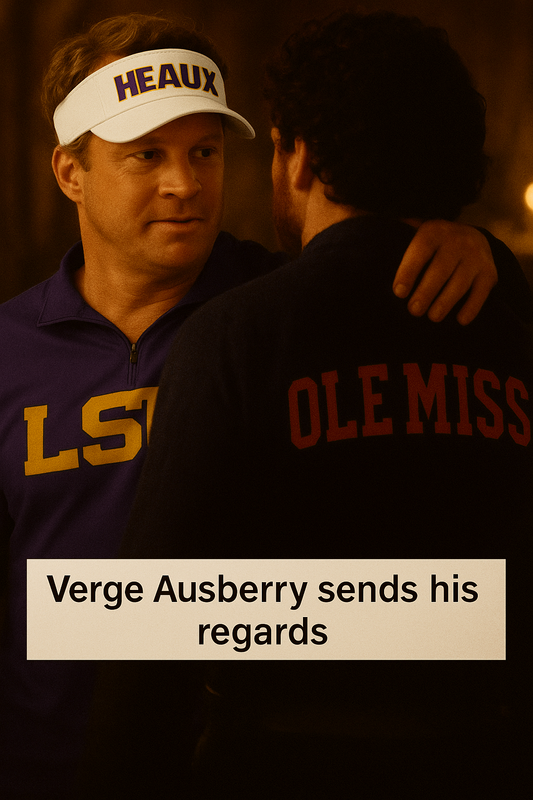

re: Reb Wedding

Posted by Jakesonaplane on 11/30/25 at 11:06 pm to Cosmo

quote:

Need to recaption that gif as “verge sends his regards”

Couldn’t make it a gif but I did my best

re: Pat Fitzgerald expected to be Michigan state’s top target for next HC

Posted by Jakesonaplane on 11/30/25 at 1:29 pm to HailHailtoMichigan!

He’s no Brian Kelly that’s for sure

re: What will the board refer to Lane as

Posted by Jakesonaplane on 11/30/25 at 1:16 pm to lsusieg25

Kiffdawg

re: When will LSU learn

Posted by Jakesonaplane on 11/30/25 at 1:08 pm to Fat Bastard

quote:

i only wish you the best with my one of my favorite baws who coached here

I will never forgive Denbrock for lying to me

re: It's not matter of if, it's a matter of when, that Kiffin departs LSU.

Posted by Jakesonaplane on 11/30/25 at 12:59 pm to Crappieman

D.

Unless its C, or B, or A

Unless its C, or B, or A

re: Philly was spot on

Posted by Jakesonaplane on 11/30/25 at 12:51 pm to Oates Mustache

quote:

Pretty sure Saban isn't the new coach.

The situation was fluid brah

re: On the heaux thing

Posted by Jakesonaplane on 11/30/25 at 12:47 pm to billjamin

Popular

0

0