| Favorite team: | LSU |

| Location: | Dallas |

| Biography: | Born in the 60s |

| Interests: | |

| Occupation: | |

| Number of Posts: | 902 |

| Registered on: | 1/27/2010 |

| Online Status: | Not Online |

Recent Posts

Message

Sentiment is looking to sell the news so expect next week to be down. March overall will be up from February levels

It’s good to point out his 18 million share position, he has a bias.

He’s definitely cheerleading.

Intrigued by the possibilities of this technology/application. Controlling my excitement as some of the multiples being thrown out are in some cases appear too good to be true.

Have added to my position over the last couple days. Enough to be entertained by the inevitable roller coaster and best case retire me a few years earlier.

He’s definitely cheerleading.

Intrigued by the possibilities of this technology/application. Controlling my excitement as some of the multiples being thrown out are in some cases appear too good to be true.

Have added to my position over the last couple days. Enough to be entertained by the inevitable roller coaster and best case retire me a few years earlier.

Yup. It never makes sense. Buy and hold.

re: Anyone else wondering if they make it to retirement b/c of AI?

Posted by kaaj24 on 2/25/26 at 4:42 pm to ghost2most

I think it’s 5-10 years out before it gets really disruptive to jobs that you have to think.

If you in data entry or basic office shite then less than 3 years.

If you in data entry or basic office shite then less than 3 years.

Trying to decide if I should add more. Share count is 3k+. Average cost is about 1.64 per share.

re: Seems we'll be bombing Iran soon, so...

Posted by kaaj24 on 2/22/26 at 2:49 pm to Handsome Pete

Another blip but since I’m not a day trader nothing to see here.

Agree. Schwab is legit.

Invest based on your risk preference. Is it possible that will have a market downturn at some point. Yes. Will it come back up and exceed prior highs. Yes

re: Four "tax friendly' states that are actually money pits for retirees

Posted by kaaj24 on 2/15/26 at 7:32 am to Everyday Is Saturday

If your flexible of where you want to live in retirement worth it to consider total tax based on your situation including income streams.

re: Needs met stay 100% invested?

Posted by kaaj24 on 2/12/26 at 3:33 pm to TorchtheFlyingTiger

I plan to have 2 years of living expenses in cash.

The rest in stocks. If stock market is up 4% or more collect money from stocks for living expenses for the year.

If down 4% or more take living expenses from cash.

Replenish cash in good stock market years.

The rest in stocks. If stock market is up 4% or more collect money from stocks for living expenses for the year.

If down 4% or more take living expenses from cash.

Replenish cash in good stock market years.

I think Bitcoin will be up over long term. A lot of money has been flowing out of BTC to PM last several months.

That’ll change. These corrections are healthy. It’s interesting how a few weeks or few months of a charge in prices gets people spooked.

That’ll change. These corrections are healthy. It’s interesting how a few weeks or few months of a charge in prices gets people spooked.

Scared money don’t make money.

This is a speculative play.

Thanks

This is a speculative play.

Thanks

Hard to say floor but it got ahead of itself.

Gold probably finishes the year low to mid 5k.

Silver probably high 60s

I’m not better than a blind monkey so don’t trade on my lack of knowledge

Gold probably finishes the year low to mid 5k.

Silver probably high 60s

I’m not better than a blind monkey so don’t trade on my lack of knowledge

Not an LSU bar but Loose Box in London shows all the SEC football games. Stays open till 4am

re: Trump’s Justice Department launches a criminal investigation of Fed chair; JPow responds

Posted by kaaj24 on 1/11/26 at 9:10 pm to rickgrimes

Silly move by Trump. Very much dislike what is going on at the federal government by executive branch. Legislative branch is worthless.

A buying opportunity.

A buying opportunity.

re: Pay off small condo or invest?

Posted by kaaj24 on 1/11/26 at 6:42 pm to Billy Blanks

Invest is the better math.

Payoff brings peace of mind.

Whichever works for you best

Payoff brings peace of mind.

Whichever works for you best

Check your state laws. They dictate how long you can wait to pay after pay period ends

Yeah, this is a terrible idea. Something the new mayor of New York would peddle as it sounds good on the surface.

A lot of bad unintended consequences will happen

A lot of bad unintended consequences will happen

re: Thoughts on Costco stock

Posted by kaaj24 on 1/5/26 at 7:13 pm to UltimaParadox

Yes, I look at the hot dog and soda metric. If they keep it locked in. I never see the place empty by me

re: Thoughts on Costco stock

Posted by kaaj24 on 1/5/26 at 7:04 pm to TorchtheFlyingTiger

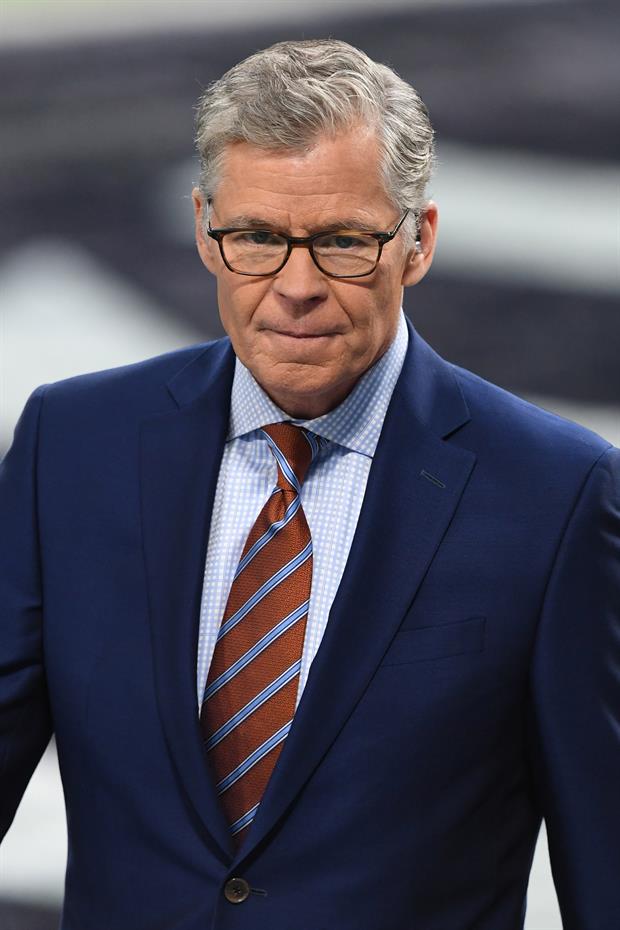

Inverse Cramer does well.

Cramer is entertaining but I wouldn’t take stock advice from him.

Cramer is entertaining but I wouldn’t take stock advice from him.

Costco is a buy and hold stock in my portfolio

Popular

1

1