FAT SEXY

| Favorite team: | Rice |

| Location: | California |

| Biography: | |

| Interests: | |

| Occupation: | |

| Number of Posts: | 1746 |

| Registered on: | 6/26/2020 |

| Online Status: | Online |

Recent Posts

Message

re: If Indiana can win a natty in football, why can’t Aggy?

Posted by FAT SEXY on 2/10/26 at 10:45 pm to bamabaseballsec

If Texas Tech, SMU and TCU can make the CFP, why can't Rice?

re: America borrowed $43.5 billion a week in the first four months of the fiscal year

Posted by FAT SEXY on 2/10/26 at 3:13 pm to ragincajun03

This board sucks outside of football season

Posted by FAT SEXY on 2/10/26 at 2:08 am

I said what I said

Gold has a track record spanning back thousands of years. It's engrained into the human psyche and culture.

That's why it's $5k.. because it's one of the few things that the broader world actually trusts.

It's eternal.

That's why it's $5k.. because it's one of the few things that the broader world actually trusts.

It's eternal.

re: Silver Bugs thread: Silver up 12% for the week on Black Friday started the journey

Posted by FAT SEXY on 2/9/26 at 12:26 pm to KCSilverTiger

I'm trying to imagine the premiums on ASEs if it gets to $50

Do any of you baws have a Sigma Metalytics machine?

re: Silver Bugs thread: Silver up 12% for the week on Black Friday started the journey

Posted by FAT SEXY on 2/7/26 at 3:13 pm to SlowFlowPro

I have all that stuff too*. I have a lot of "preps".. but it's not from a doomsday angle really. I seal dry goods I buy in bulk in mylar. I have hundreds of pounds of rice, sugar, beans etc that I secured years ago at much lower prices than they're at now. I consume and rotate accordingly. Sugar and salt last forever if stored properly.

*I do want to build a rain catch system. Again, not from a doomsday standpoint, but more because I find stuff like that fun and it could pay for itself.

FF - Instant Coffee granules can last for 20+ years sealed in mylar. It's nearly doubled in price since the last big set that I sealed. Regular coffee grinds don't hold nearly as long.

I'm not envisioning the apocalypse, but rather a continuous trickle of value leaving the dollar. The can just keeps getting kicked.

*I do want to build a rain catch system. Again, not from a doomsday standpoint, but more because I find stuff like that fun and it could pay for itself.

FF - Instant Coffee granules can last for 20+ years sealed in mylar. It's nearly doubled in price since the last big set that I sealed. Regular coffee grinds don't hold nearly as long.

I'm not envisioning the apocalypse, but rather a continuous trickle of value leaving the dollar. The can just keeps getting kicked.

re: What’s the worst Vanguard fund?

Posted by FAT SEXY on 2/7/26 at 2:10 pm to Paul Allen

VPU is my favorite. Utilities

I'm not going to try and predict price. What's the old adage? "Markets can remain irrational longer than you can remain solvent."

It's a long game, not a get rich quick scheme. I did sell some less pure stuff recently, but the bulk of my stack is a multi-decade hold.

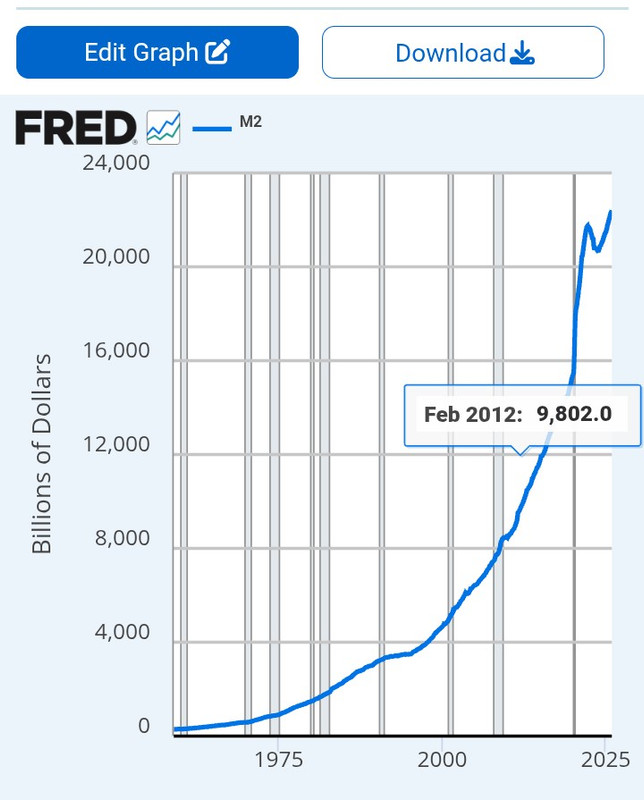

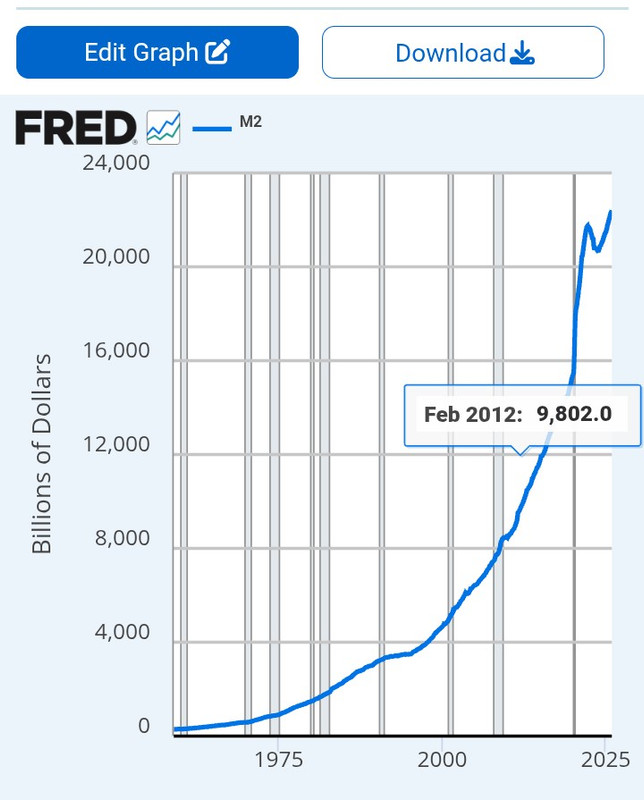

M2 Money Supply Chart

As long as that keeps going up and the demand for Silver remains (or increases) in this ever expanding technological society we find ourselves in, then price can only trend upwards

It's a long game, not a get rich quick scheme. I did sell some less pure stuff recently, but the bulk of my stack is a multi-decade hold.

M2 Money Supply Chart

As long as that keeps going up and the demand for Silver remains (or increases) in this ever expanding technological society we find ourselves in, then price can only trend upwards

re: Will the Bitcoin selling start accelerating?

Posted by FAT SEXY on 2/7/26 at 1:16 pm to TigerTatorTots

The difference: Gold/Silver weren't just "created" out of thin air by some person/agency. They're actual elements, not numbers on a screen. They'll still be here and valued by humans when the current systems are nothing more than a footnote in the history books.

It's easier for me to believe in something that has practical real world applications, on top of track records of being money going back thousands of years.

BTC could go to zero, Silver & Gold simply cannot. I don't view them as risky/speculative on a long time scale

I'm probably derailing the thread, so apologies

It's easier for me to believe in something that has practical real world applications, on top of track records of being money going back thousands of years.

BTC could go to zero, Silver & Gold simply cannot. I don't view them as risky/speculative on a long time scale

I'm probably derailing the thread, so apologies

re: Will the Bitcoin selling start accelerating?

Posted by FAT SEXY on 2/7/26 at 2:21 am to TigerTatorTots

Bitcoin has the most fugly/fake looking chart I've ever seen.

It has institutional pump & dump written all over it.

If it rockets randomly again, more power to the people buying it deep, but it'll only reaffirm my belief that institutional money is pumping it.

It has no support structure at all. It jumps fast and then bleeds out until the next cycle.

It's musical chairs on when the game stops and that's why I won't buy it.

When does it actually switch from this gambit to a stable asset?

My theory: it's a government ploy to suck M2 liquidity rather than an organic movement. Either that, or they hijacked it. They were probably hoping the world would start buying into it, which really isn't happening.

It has institutional pump & dump written all over it.

If it rockets randomly again, more power to the people buying it deep, but it'll only reaffirm my belief that institutional money is pumping it.

It has no support structure at all. It jumps fast and then bleeds out until the next cycle.

It's musical chairs on when the game stops and that's why I won't buy it.

When does it actually switch from this gambit to a stable asset?

My theory: it's a government ploy to suck M2 liquidity rather than an organic movement. Either that, or they hijacked it. They were probably hoping the world would start buying into it, which really isn't happening.

Good analysis on recent trends.

Though, going back to prior performance shows that the Silver market lacks overall stability. It's a playground of shenanigans and traders looking to dip in and out. SLV stock in particular is loaded with traders that treat it like an average stock.

Gold isn't like that and you can see it played out in the GSR.

We need to see a market molded into an actual physical reality with Ag. The derivatives market in Silver needs a massive overhaul IMO.

SOAP BOX MOMENT

To any lurkers or new stackers in here: Buy the coins or bars that you like for the best premium possible. Enjoy building a physical collection. Don't look at it as anything more than a long scheme foundation to your portfolio. Try not to obsess over price so much and just build exposure to the market. Physical precious metals reward patience.

You're quite literally buying the most proven monetary assets in human history (Outside of real estate).. don't look to buy bullion in order to flip it like you would a stock. It's a process.

If you don't want to stack physical, Id advise you to buy the mining ETFs over bullion funds. If prices remain strong these companies are going to start printing.

Though, going back to prior performance shows that the Silver market lacks overall stability. It's a playground of shenanigans and traders looking to dip in and out. SLV stock in particular is loaded with traders that treat it like an average stock.

Gold isn't like that and you can see it played out in the GSR.

We need to see a market molded into an actual physical reality with Ag. The derivatives market in Silver needs a massive overhaul IMO.

SOAP BOX MOMENT

To any lurkers or new stackers in here: Buy the coins or bars that you like for the best premium possible. Enjoy building a physical collection. Don't look at it as anything more than a long scheme foundation to your portfolio. Try not to obsess over price so much and just build exposure to the market. Physical precious metals reward patience.

You're quite literally buying the most proven monetary assets in human history (Outside of real estate).. don't look to buy bullion in order to flip it like you would a stock. It's a process.

If you don't want to stack physical, Id advise you to buy the mining ETFs over bullion funds. If prices remain strong these companies are going to start printing.

re: Silver Bugs thread: Silver up 12% for the week on Black Friday started the journey

Posted by FAT SEXY on 2/6/26 at 3:54 pm to TigerTatorTots

The current 6 Month Gold Chart is a uniformed thing of beauty :bow:

re: Coyote swims to Alcatraz

Posted by FAT SEXY on 2/6/26 at 3:33 pm to Seth Bullock

quote:

Cormorant

Ancient Japanese Baws used to use them to fish with.

.jpg)

Coyote swims to Alcatraz

Posted by FAT SEXY on 2/6/26 at 3:08 pm

Was seen swimming towards the island on Jan. 11.

SFGATE Article

Plans are in place to safely trap and relocate this little baw before he decimates the local cormorant population

.webp)

SFGATE Article

Plans are in place to safely trap and relocate this little baw before he decimates the local cormorant population

quote:

The evidence is all around us: A trail of paw prints in the sand. A couple of droppings here and there. The carcass of a bird that, by at least one assessment, looks as if it’s been “picked clean.”

.webp)

I wonder what creative ways the fedgov will come up with next to kick the can down the road a little further

Do you think Millennials/Gen Z will "hold down" the stock markets in the coming decades?

Posted by FAT SEXY on 2/6/26 at 1:08 am

When Boomers/Gen X start trickling out of the markets in the coming years do you think the next generation(s) will carry the baton at a similar level?

I have my doubts.

I have my doubts.

quote:

pretend magic computer money

If only there were two very real elements that had monetary track records that span back thousands of years.

re: Silver Bugs thread: Silver up 12% for the week on Black Friday started the journey

Posted by FAT SEXY on 2/5/26 at 9:40 pm to RollTide4Ever

quote:

The real price is in China.

It'll be interesting to see what happens in the western markets when the Chinese exchanges are closed for their New Year

re: Silver Bugs thread: Silver up 12% for the week on Black Friday started the journey

Posted by FAT SEXY on 2/5/26 at 9:23 pm to lsuconnman

quote:

Nah, I got bigger problems to solve trying to figure out what to about my UNH bags.

Buffet pump caused a bull trap.

re: Silver Bugs thread: Silver up 12% for the week on Black Friday started the journey

Posted by FAT SEXY on 2/5/26 at 8:35 pm to lsuconnman

Are you gonna add some bullion if it gets that low?

Popular

0

0