Doc Fenton

| Favorite team: | LSU |

| Location: | New York, NY |

| Biography: | |

| Interests: | |

| Occupation: | |

| Number of Posts: | 52698 |

| Registered on: | 2/27/2007 |

| Online Status: | Not Online |

Recent Posts

Message

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 4/29/19 at 6:15 pm to Doc Fenton

I was dreading the approach of this day.

The previous 2,940.91 high from 9/21/2018 has been surpassed. Egg on my face. I was wrong.

I still maintain my main thesis about current overvaluation and how bad the severity of the end of this bull market is going to be, and I still see gigantic never-before-seen divergences and other historical oddities. I still have a very large portion of my portfolio in cash (i.e., cash + short-term bonds), I took decent precautions regarding my allocations, and I don't feel bad about missing out on gains this year.

Still, there's no excusing the losses I've incurred over the first 4 months of this year. I entered too hard in late January on the faintest of signals of increasing VIX without waiting for more evidence that the next leg down had actually commenced, or that unemployment had actually bottomed.

On the brighter side, I think I've learned a valuable lesson, and I still have tons of dry powder to make money once this whale of a rally finally flips course. But I'll be more humble about it, and try to just take what the market's giving me, rather than trying to be such a front-runner. I will live to see better days ahead, hopefully sooner rather than later.

For those who have been bullish or else just passively invested in equities this year, congrats. You've eaten my lunch for the first 1/3 of the year.

quote:

If the markets go another 5% or so higher and exceed the Fall 2018 peak, then that will certainly be egg on my face

The previous 2,940.91 high from 9/21/2018 has been surpassed. Egg on my face. I was wrong.

I still maintain my main thesis about current overvaluation and how bad the severity of the end of this bull market is going to be, and I still see gigantic never-before-seen divergences and other historical oddities. I still have a very large portion of my portfolio in cash (i.e., cash + short-term bonds), I took decent precautions regarding my allocations, and I don't feel bad about missing out on gains this year.

Still, there's no excusing the losses I've incurred over the first 4 months of this year. I entered too hard in late January on the faintest of signals of increasing VIX without waiting for more evidence that the next leg down had actually commenced, or that unemployment had actually bottomed.

On the brighter side, I think I've learned a valuable lesson, and I still have tons of dry powder to make money once this whale of a rally finally flips course. But I'll be more humble about it, and try to just take what the market's giving me, rather than trying to be such a front-runner. I will live to see better days ahead, hopefully sooner rather than later.

For those who have been bullish or else just passively invested in equities this year, congrats. You've eaten my lunch for the first 1/3 of the year.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 3/30/19 at 12:30 pm to BennyAndTheInkJets

Good to see you again, and I didn't mean to get your heart rate up!

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 3/27/19 at 5:55 pm to LSUtoOmaha

It's always difficult to tell how much Fed officials are swayed by political pressure, but clearly the 60 Minutes appearance earlier this month demonstrates his concern for the need to project political legitimacy for his decision-making process.

The things that Fed officials say (including Bernanke, Yellen, and Powell) are often nonsense, and evince a lack of wider understanding on their part, but from a technical perspective, I do sympathize with their plight. The ECB is considering buying equities, the FRB is no longer afraid to bring up the subject of negative interest rates, and you have Yellen and Stephen Moore recently sending signals for even more rate cuts. And yeah, it seems kind of ridiculous how blase they are about this.

From my perspective though, the damage was already done from erroneous policy decisions made from 2011 to 2017. And even for that, it's difficult to fault the Fed decision-makers themselves, since they're obligated to pay attention to employment and consumer inflation, and aren't allowed to base their decisions primarily on other considerations that I think are more important. (This is why I advocate for a different monetary policy regime than the one we currently have.)

That being said, Jerome is clearly looking at market signals (which was the standard scouting report on him from the get-go) and is making things outside of employment & inflation a huge part of his decision-making process. I'm willing to give him wide latitude even for that though, since it is true that those things will ultimately affect U.S. consumer inflation. (I still think it's funny how he's careful to always cite global conditions outside the U.S., rather than admit that it's worrisome U.S. conditions that might be influencing him.)

Bottom line: It's the Fed decisions in the middle of bull cycles that worry me. The Fed decisions during transition periods (like the one I believe we're in right now) are probably too late in the game to change things very much.

The things that Fed officials say (including Bernanke, Yellen, and Powell) are often nonsense, and evince a lack of wider understanding on their part, but from a technical perspective, I do sympathize with their plight. The ECB is considering buying equities, the FRB is no longer afraid to bring up the subject of negative interest rates, and you have Yellen and Stephen Moore recently sending signals for even more rate cuts. And yeah, it seems kind of ridiculous how blase they are about this.

From my perspective though, the damage was already done from erroneous policy decisions made from 2011 to 2017. And even for that, it's difficult to fault the Fed decision-makers themselves, since they're obligated to pay attention to employment and consumer inflation, and aren't allowed to base their decisions primarily on other considerations that I think are more important. (This is why I advocate for a different monetary policy regime than the one we currently have.)

That being said, Jerome is clearly looking at market signals (which was the standard scouting report on him from the get-go) and is making things outside of employment & inflation a huge part of his decision-making process. I'm willing to give him wide latitude even for that though, since it is true that those things will ultimately affect U.S. consumer inflation. (I still think it's funny how he's careful to always cite global conditions outside the U.S., rather than admit that it's worrisome U.S. conditions that might be influencing him.)

Bottom line: It's the Fed decisions in the middle of bull cycles that worry me. The Fed decisions during transition periods (like the one I believe we're in right now) are probably too late in the game to change things very much.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 3/27/19 at 5:55 pm to Doc Fenton

Some thoughts of mine on the yield curve inversions, assisted by some recent tweets from the fintwit realm:

#1. The zero bound for the inversion signal is not a magic level. Logically speaking, it becomes much more difficult for poor future economic growth signals to cause a yield curve to invert as short-term bond yields get closer to zero. Ergo, an inversion in a near-ZIRP environment is a much stronger signal than an inversion in, say, 1980. If you normalize a 0bp-inversion in normal times to a 75bp-inversion in the current low-rate environment (see Raoul Pal below), then the signal occurred a long time ago, somewhere between Nov 2017 and Feb 2018.

#2. You have to place the inversion in context of where we are in the secular interest rate cycle. Whereas the period around 1980 was near the top of the cycle, the period around 2016 (or 1946 previously) is near the bottom of the cycle. So we should already be in a secular cycle of increasing yields (remember all those high yield projections last year?), which makes the sharp decrease in nominal growth expectations even more remarkable. Additionally, you might add on the concern that interest rate cuts by the Fed in the immediate aftermath of a cycle of continued hikes is usually a bad time for markets.

#3. You have to look at the inversions across different maturity points in context. Some have claimed that nothing matters until there's a 10-2-yr inversion (which has not yet happened) or a 10yr-3mo inversion (which has now happened), but from a common sense theoretical approach (see Guy LeBas below), it's the portion out to about 2-3 years that matters for "imminent" growth signals.

#4. Empirically speaking, stocks have not had good returns during inversions (see Jesse Felder below), and the "Nike Swoosh" pattern across the whole yield curve could be ominous (see "OddStats" below).

Raoul Pal on 3/24/2019

Guy LeBas on 3/24/2019

Jesse Felder on 3/25/2019

" OddStats" on 3/27/2019

#1. The zero bound for the inversion signal is not a magic level. Logically speaking, it becomes much more difficult for poor future economic growth signals to cause a yield curve to invert as short-term bond yields get closer to zero. Ergo, an inversion in a near-ZIRP environment is a much stronger signal than an inversion in, say, 1980. If you normalize a 0bp-inversion in normal times to a 75bp-inversion in the current low-rate environment (see Raoul Pal below), then the signal occurred a long time ago, somewhere between Nov 2017 and Feb 2018.

#2. You have to place the inversion in context of where we are in the secular interest rate cycle. Whereas the period around 1980 was near the top of the cycle, the period around 2016 (or 1946 previously) is near the bottom of the cycle. So we should already be in a secular cycle of increasing yields (remember all those high yield projections last year?), which makes the sharp decrease in nominal growth expectations even more remarkable. Additionally, you might add on the concern that interest rate cuts by the Fed in the immediate aftermath of a cycle of continued hikes is usually a bad time for markets.

#3. You have to look at the inversions across different maturity points in context. Some have claimed that nothing matters until there's a 10-2-yr inversion (which has not yet happened) or a 10yr-3mo inversion (which has now happened), but from a common sense theoretical approach (see Guy LeBas below), it's the portion out to about 2-3 years that matters for "imminent" growth signals.

#4. Empirically speaking, stocks have not had good returns during inversions (see Jesse Felder below), and the "Nike Swoosh" pattern across the whole yield curve could be ominous (see "OddStats" below).

Raoul Pal on 3/24/2019

quote:

I swore I wouldn’t discuss YC twitter but...

If you normalize the curve for ultra low rates my work suggests that 75bps = 0bps ( roughly) and the curve is probably suggesting a deep inversion already. This is consistent with Japan and Europe.

... it’s too late.

Guy LeBas on 3/24/2019

quote:

Different parts of curve provide economic signals over different time periods.

A 3m/2s inversion is an imminent growth signal while a 10s/30s inversion would most likely be about decadal inflation trends.

Jesse Felder on 3/25/2019

quote:

Stocks have historically lost money on an annualized basis when the yield curve’s been inverted. LINK

" OddStats" on 3/27/2019

quote:

The Yield Curve right now looks like a Nike Swoosh and you were wondering when that's happened in the past.

I looked at every time since 1982 that the 2yr yield was below both the 3mo yield and 10yr yield (like now).

Here it is on a $SPX chart.

Oof.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 3/20/19 at 11:00 pm to Doc Fenton

The big news of the day was undoubtedly Powell's statements coming out of the Fed meeting. He seemed to take a softer tone on fighting inflation than perhaps a segment of the investing world was expecting, but the genuine news was his announcement that the Fed's balance sheet unwinding would be tapered down in May, and set to be completed by September.

CNBC: " Fed gives market what it wanted — it’s ending its balance-sheet reduction in September"

We've come a long way since Powell's "autopilot" remarks on Wednesday, December 19, 2018.

Anyway, the S&P 500 index traded as high as 2852.42 yesterday before closing at 2832.57, slightly below Monday's close. Then the index was trading as low as 2812.43 early this afternoon, before shooting up from 2819 to 2842 (about 0.8%), before dropping back down and closing the day at 2824.23 (about 0.6% off the daily peak; and about 1.0% off the peak from yesterday).

Additionally, Powell's statements had ominous effects on the inverting yield curve, which is undeniably bearish at this point. The 7-year yield is now over 4 bp below the 1-month yield, and the 10-year yield is now only 4 bp away from inverting with the 6-month yield. I don't think there are any historical cases where this hasn't spelled trouble. The bond markets are undeniably signaling poor economic prospects going forward.

Quod erat demonstrandum.

CNBC: " Fed gives market what it wanted — it’s ending its balance-sheet reduction in September"

We've come a long way since Powell's "autopilot" remarks on Wednesday, December 19, 2018.

Anyway, the S&P 500 index traded as high as 2852.42 yesterday before closing at 2832.57, slightly below Monday's close. Then the index was trading as low as 2812.43 early this afternoon, before shooting up from 2819 to 2842 (about 0.8%), before dropping back down and closing the day at 2824.23 (about 0.6% off the daily peak; and about 1.0% off the peak from yesterday).

Additionally, Powell's statements had ominous effects on the inverting yield curve, which is undeniably bearish at this point. The 7-year yield is now over 4 bp below the 1-month yield, and the 10-year yield is now only 4 bp away from inverting with the 6-month yield. I don't think there are any historical cases where this hasn't spelled trouble. The bond markets are undeniably signaling poor economic prospects going forward.

quote:

When I claimed that the Fed is out of ammunition, I meant that in the context of having ammunition to prevent the onset of a bear market, since at some juncture, we reach a tipping point where dovish actions by the Fed signals an economic contraction, and thus will tend to have the bad-economic-signals bear effects start to outweigh the looser-monetary-policy bull effects, in terms of moving the market up or down in short-term response.

Quod erat demonstrandum.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 3/20/19 at 11:00 pm to CajunTiger92

Well I appreciate that post, because it's important for any active investor to periodically make a critical reappraisal of where we are in the market cycle. Certainly, I've had a bad couple of months, and it's led me to go back and re-question my assumptions.

Having done that, however, I can't find any sufficient justification to abandon my positions. All the advice about maintaining your calm and being rational when the markets are emotional--all that advice holds for bears as well as for bulls. It's not as simple of course, because the long-term drift of the market is up, not down, but on a general philosophical level, I feel like I've got winning positions, and I just need to be calm and stay the course.

Your point about the worry of bears helping to feed opportunity for bulls is well taken. However, it's also missing the other side of the coin. Whatever bricks of worry there are that build the foundation for sustainable bull runs (think of all the worry from 1974-1982), there are also bricks of bulls feeling invincible that build the foundation for gruesome bear markets.

Which brings us to the point of how we can interpret the current signs. (Note that if you're a passive investor, you don't have to worry about this; but that also means you should be agnostic about whether we are currently in a bull or a bear market, and not give cliched "buy the dips" advice.) Some would say that it's a Rorschach test. Others would say I'm cherry picking the bad news over the good.

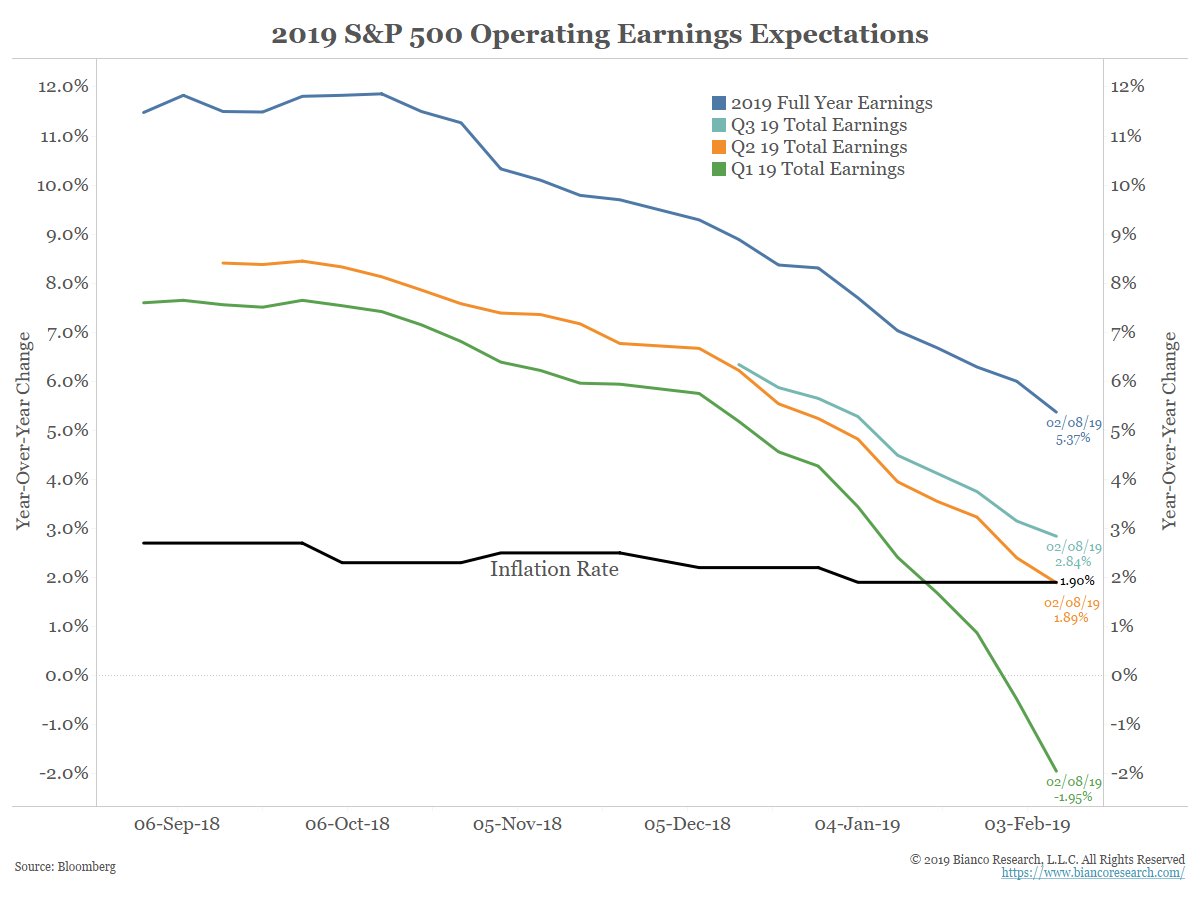

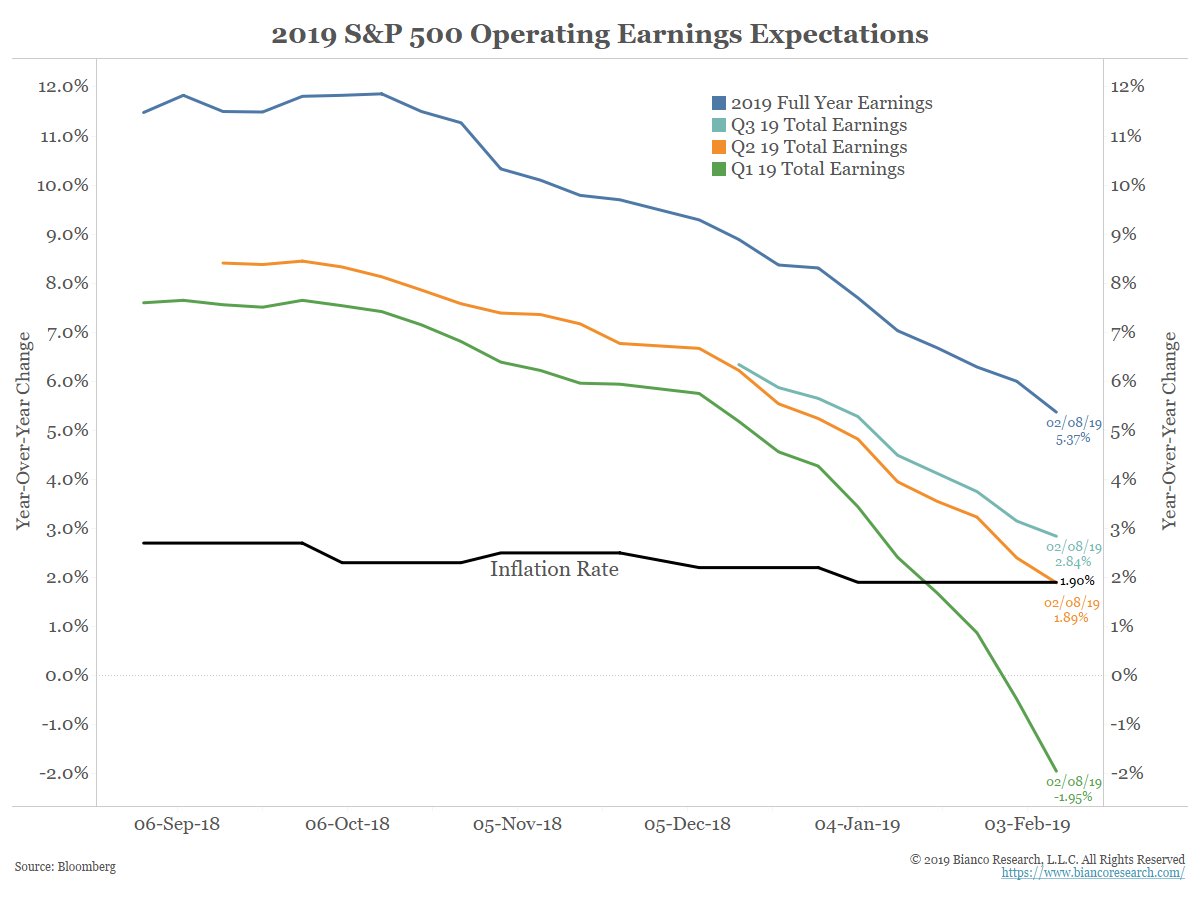

Well, I've gone back and re-examined what's occurred since 12/24/2018, and I see almost nothing to indicate a mixed bag here. It's been very one-sided and unquestionably worse than expectations. If you look at global leading indicators like semiconductor shipments, M1 growth, FedEx sales growth, etc., you see bad information. Here in the U.S. we have falling home prices and falling EPS projections for 2019. The falling EPS projections drove some of the correction from September to December last year, but--and this point can't be emphasized enough--those projections have continued dropping from 12/31/2018 to the present day.

This rally has been led by large institutional investors reacting to shifting expectations of monetary policy, and rosy speculation about U.S.-China trade talks. That's it. The only good economic data you can point to for 2019 are the following: (1) low unemployment (which of course is a two-sided omen); (2) good consumer confidence; and (3) well-capitalized banks showing low default rates from consumer borrowers.

But that's not going to make up for stalling sales revenue and an evaporating market for leveraged corporate debt issuance. It'll catch up to us eventually.

In addition to all that stuff about the underlying economy, you can look at the mechanics of the rally itself and be confident in assessing it as a bear market phenomenon. In and of itself, this compressed, V-shape market action is a very bearish sign. Even looking at 1987, the most hopeful analogy for bulls, this rally is nothing at all like the multi-year recovery that happened post-October-1987.

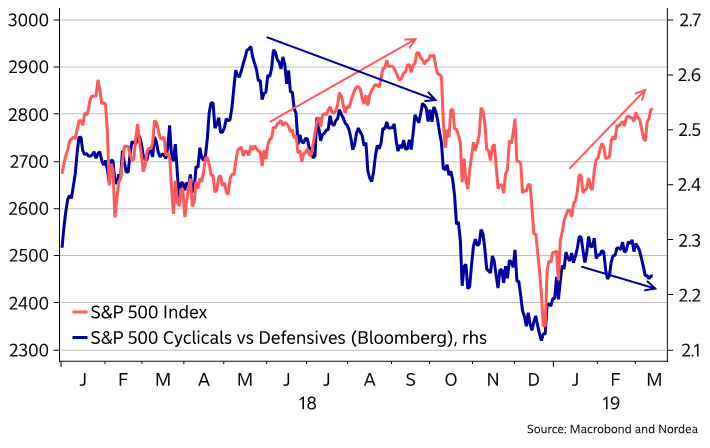

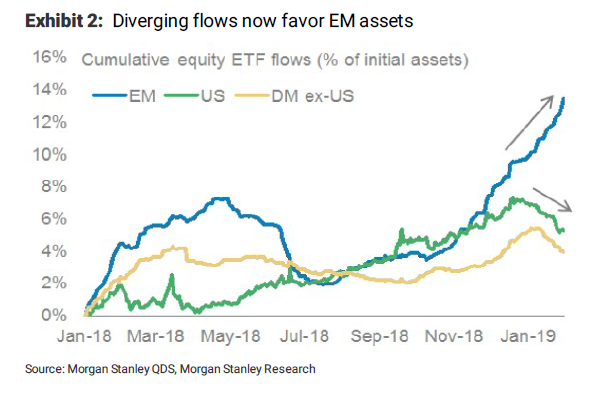

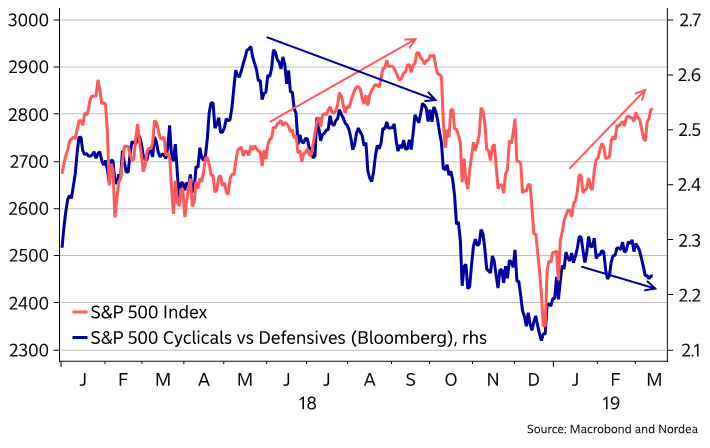

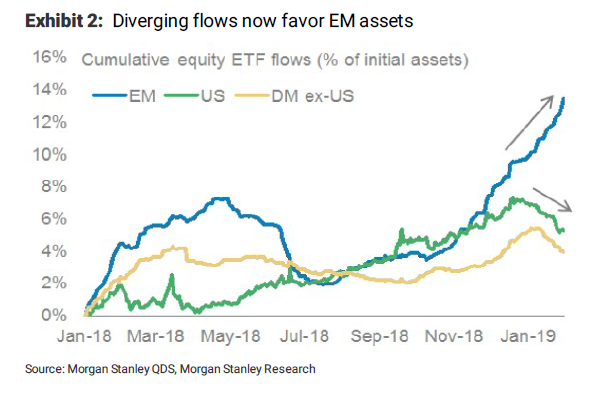

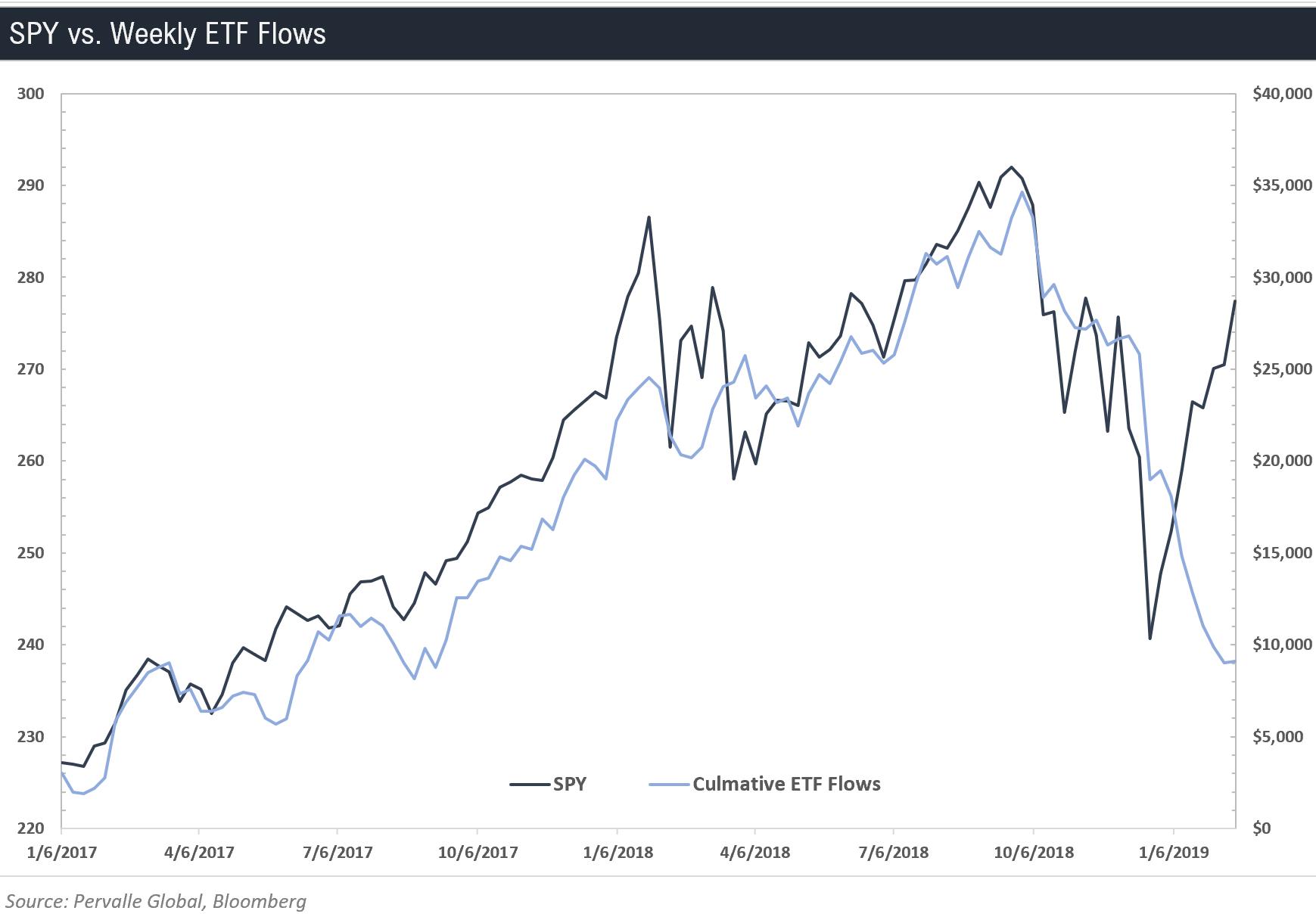

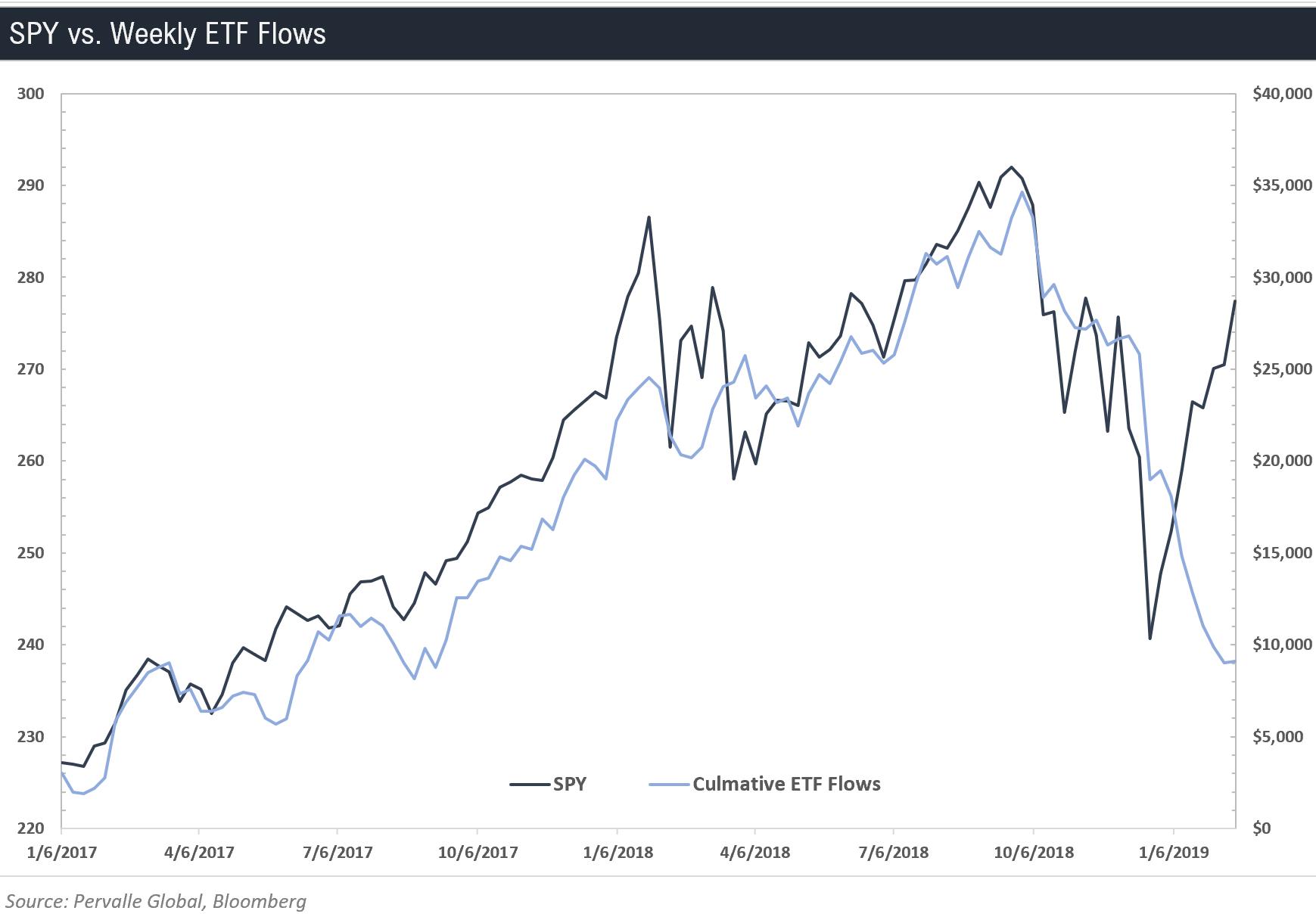

Scrolling through the financial media, you'll see example after example of so-called "alligator" charts--i.e., charts showing unusually sharp divergences that resemble the mouth of an alligator. Look at (1) the market vs. transportation indexes; (2) cyclicals vs. defensives; (3) U.S. equity ETF flows vs. EM equity ETF flows; (4) smart money flows; (5) consumer confidence rates vs. savings rates; etc. It all looks freakishly bad. Do not trust this rally as being indicative of market health.

Having done that, however, I can't find any sufficient justification to abandon my positions. All the advice about maintaining your calm and being rational when the markets are emotional--all that advice holds for bears as well as for bulls. It's not as simple of course, because the long-term drift of the market is up, not down, but on a general philosophical level, I feel like I've got winning positions, and I just need to be calm and stay the course.

Your point about the worry of bears helping to feed opportunity for bulls is well taken. However, it's also missing the other side of the coin. Whatever bricks of worry there are that build the foundation for sustainable bull runs (think of all the worry from 1974-1982), there are also bricks of bulls feeling invincible that build the foundation for gruesome bear markets.

Which brings us to the point of how we can interpret the current signs. (Note that if you're a passive investor, you don't have to worry about this; but that also means you should be agnostic about whether we are currently in a bull or a bear market, and not give cliched "buy the dips" advice.) Some would say that it's a Rorschach test. Others would say I'm cherry picking the bad news over the good.

Well, I've gone back and re-examined what's occurred since 12/24/2018, and I see almost nothing to indicate a mixed bag here. It's been very one-sided and unquestionably worse than expectations. If you look at global leading indicators like semiconductor shipments, M1 growth, FedEx sales growth, etc., you see bad information. Here in the U.S. we have falling home prices and falling EPS projections for 2019. The falling EPS projections drove some of the correction from September to December last year, but--and this point can't be emphasized enough--those projections have continued dropping from 12/31/2018 to the present day.

This rally has been led by large institutional investors reacting to shifting expectations of monetary policy, and rosy speculation about U.S.-China trade talks. That's it. The only good economic data you can point to for 2019 are the following: (1) low unemployment (which of course is a two-sided omen); (2) good consumer confidence; and (3) well-capitalized banks showing low default rates from consumer borrowers.

But that's not going to make up for stalling sales revenue and an evaporating market for leveraged corporate debt issuance. It'll catch up to us eventually.

In addition to all that stuff about the underlying economy, you can look at the mechanics of the rally itself and be confident in assessing it as a bear market phenomenon. In and of itself, this compressed, V-shape market action is a very bearish sign. Even looking at 1987, the most hopeful analogy for bulls, this rally is nothing at all like the multi-year recovery that happened post-October-1987.

Scrolling through the financial media, you'll see example after example of so-called "alligator" charts--i.e., charts showing unusually sharp divergences that resemble the mouth of an alligator. Look at (1) the market vs. transportation indexes; (2) cyclicals vs. defensives; (3) U.S. equity ETF flows vs. EM equity ETF flows; (4) smart money flows; (5) consumer confidence rates vs. savings rates; etc. It all looks freakishly bad. Do not trust this rally as being indicative of market health.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 3/11/19 at 11:33 pm to Pendulum

AAPL, +3.46%

AMZN, +3.07%

GOOG, +2.93%

NFLX, +2.65%

FB, +1.46%

Well I didn't see that coming. Helluva day for FAANG.

All while the terrible news on inventories and the underlying economy keep coming. Curious, to say the least.

AMZN, +3.07%

GOOG, +2.93%

NFLX, +2.65%

FB, +1.46%

Well I didn't see that coming. Helluva day for FAANG.

All while the terrible news on inventories and the underlying economy keep coming. Curious, to say the least.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 3/10/19 at 6:45 pm to Qwertyburd

ForexLive at 7:34pm ET: " China asks domestic airlines to ground Boeing 737 MAX"

Buckle up.

quote:

Caijing report

Boeing is going to face some pressure for a full-scale grounding until some details of the Ethiopian Air crash are revealed.

There are only 350 of the planes in operation and two have crashed in the past 8 months.

Buckle up.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 3/10/19 at 12:50 pm to Pendulum

I don't know much about it, but I just looked through the recent stock history since Fall 2016, and man, that's crazy. [EDIT: But I just now figured out that you were probably referring to this crash in Ethiopia from a few hours ago.]

In any case, that run-up from 292.47 on 12/26/18 to 446.01 on 3/1/19 (+52.50% in 65 days) was definitely amazing.

In any case, that run-up from 292.47 on 12/26/18 to 446.01 on 3/1/19 (+52.50% in 65 days) was definitely amazing.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 3/9/19 at 12:09 pm to Doc Fenton

Last week was also an interesting week for TSLA, GE, and DB, three of the stocks outside of FAANG that are most emblematic of the current environment.

Tesla, I don't even want to get into. What a shitshow.

GE came out with this on Tuesday: " GE shares tumble as CEO Culp says cash flow will be negative in 2019, power unit to struggle more."

And it appears that it was mostly Deutsche Bank who successfully lobbied Draghi to announce TLTRO III on Thursday: " European stocks close lower after ECB trims growth forecast."

Fun times.

Tesla, I don't even want to get into. What a shitshow.

GE came out with this on Tuesday: " GE shares tumble as CEO Culp says cash flow will be negative in 2019, power unit to struggle more."

And it appears that it was mostly Deutsche Bank who successfully lobbied Draghi to announce TLTRO III on Thursday: " European stocks close lower after ECB trims growth forecast."

Fun times.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 3/9/19 at 11:48 am to LSUtoOmaha

I look at it more as groups of investors bouncing back and forth between two competing narratives, which is what you would expect to happen in transition periods between bull and bear markets. (It's crazy how the market recovered at the end of trading yesterday and nearly reached its Thursday close.)

The consensus view for 2019 had been that, yes, Chinese real estate was tanking and Chinese trade had cratered for Korea, Japan, etc. for the end of 2018, but that the huge PBoC stimulus put into the system had effectively turned the tide and saved the day, and Chinese stocks were poised to climb upward for the rest of the year.

But then imports in Feb 2019 fell 20.7% (vs. -4.8% expected), and imports in Feb 2019 fell 5.2% (vs. -1.4% expected) ( LINK). That's a huge divergence from consensus expectations.

There's also a consensus view that bad Dec 2018 retail sales data in the U.S. (released a few weeks ago) was a fluke, and (according to Kudlow) that the Feb 2018 job growth report was also a fluke. The consensus view is also that corporate earnings will be bad for the 1Q and mediocre for the 2Q, but will return to its normal growth trajectory in 3Q and 4Q. We'll see.

It'll be really interesting to see how the market reacts to guidance on projected corporate earnings for the 3Q and 4Q that will come out from 1Q reporting a couple of months from now.

Anyway, tomorrow will mark the 10-year anniversary of the famous Haines Bottom: " 'Haines Bottom': Remembering a legendary CNBC call 10 years later."

He called it at 9:47am ET on Tuesday, 3/10/2009. The previous day's close would be the lowest close of the bear cycle (although the famous '666' intraday low had occurred on Friday, 3/6/2009). Helluva call.

I hope to make a similar call sometime in 2020 or so. So there are definitely good days ahead. In the meantime though...

The consensus view for 2019 had been that, yes, Chinese real estate was tanking and Chinese trade had cratered for Korea, Japan, etc. for the end of 2018, but that the huge PBoC stimulus put into the system had effectively turned the tide and saved the day, and Chinese stocks were poised to climb upward for the rest of the year.

But then imports in Feb 2019 fell 20.7% (vs. -4.8% expected), and imports in Feb 2019 fell 5.2% (vs. -1.4% expected) ( LINK). That's a huge divergence from consensus expectations.

There's also a consensus view that bad Dec 2018 retail sales data in the U.S. (released a few weeks ago) was a fluke, and (according to Kudlow) that the Feb 2018 job growth report was also a fluke. The consensus view is also that corporate earnings will be bad for the 1Q and mediocre for the 2Q, but will return to its normal growth trajectory in 3Q and 4Q. We'll see.

It'll be really interesting to see how the market reacts to guidance on projected corporate earnings for the 3Q and 4Q that will come out from 1Q reporting a couple of months from now.

Anyway, tomorrow will mark the 10-year anniversary of the famous Haines Bottom: " 'Haines Bottom': Remembering a legendary CNBC call 10 years later."

He called it at 9:47am ET on Tuesday, 3/10/2009. The previous day's close would be the lowest close of the bear cycle (although the famous '666' intraday low had occurred on Friday, 3/6/2009). Helluva call.

I hope to make a similar call sometime in 2020 or so. So there are definitely good days ahead. In the meantime though...

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 2/25/19 at 9:31 pm to LSUtoOmaha

We have certainly approached an interesting inflection point.

On the one hand, we are now near the very top of the range of what most quantitative analysts have been telling us that a bear market rally could achieve. If the markets go another 5% or so higher and exceed the Fall 2018 peak, then that will certainly be egg on my face, along with a lot of other pundits out there. (I'm still waiting on that mythical "Point G" to occur, right?)

On the other hand, the bears have taken cannonball broadsides from the two factors feared the most (Fed policy and U.S.-China trade news), and the bulls no longer have much dry powder left. The Fed has been trotting out members to calm the markets on an almost daily basis, the bond markets aren't seeing any rate hikes in the future, QT might be over sooner rather than later, and yet we're still not as high as we were in September when rate hikes and QT were still expected. The unlikely tariff hikes scheduled for March 1 will not occur, and U.S.-China trade developments seem to be as much of a classic "buy the rumor, sell the news" type of event as you can get. (And I don't think any type of pending trade deal can rescue us from the effects of a deep upcoming Chinese recession at this point.)

All the while, we have been inundated with bad economic news nearly throughout the whole year-to-date so far for 2019. When the selloff of Jan/Feb 2018 occurred, I noted that it might be the beginning of the end, but I also knew that the bear market was yet to actually commence in earnest, because that particular selloff was based almost entirely on good underlying economic data (which sent bond yields too high). By the same type of logic, we can look at the underlying economic data for the recent rally--as well as the story being told by the bond markets--and understand that this time it looks very bad for the bulls.

Today we had the markets open at 2804 and quickly rise to 2813 as the worst-case scenario on Trump-Xi that the markets feared most was officially avoided. Yet near the end of trading, the market had nearly returned to its previous close of 2792, before rebounding a few points up. It's impossible to tell when exactly we'll be out of the woods for this late rally, but from a bear's perspective, it looks like it can't possibly have much steam left.

On the one hand, we are now near the very top of the range of what most quantitative analysts have been telling us that a bear market rally could achieve. If the markets go another 5% or so higher and exceed the Fall 2018 peak, then that will certainly be egg on my face, along with a lot of other pundits out there. (I'm still waiting on that mythical "Point G" to occur, right?)

On the other hand, the bears have taken cannonball broadsides from the two factors feared the most (Fed policy and U.S.-China trade news), and the bulls no longer have much dry powder left. The Fed has been trotting out members to calm the markets on an almost daily basis, the bond markets aren't seeing any rate hikes in the future, QT might be over sooner rather than later, and yet we're still not as high as we were in September when rate hikes and QT were still expected. The unlikely tariff hikes scheduled for March 1 will not occur, and U.S.-China trade developments seem to be as much of a classic "buy the rumor, sell the news" type of event as you can get. (And I don't think any type of pending trade deal can rescue us from the effects of a deep upcoming Chinese recession at this point.)

All the while, we have been inundated with bad economic news nearly throughout the whole year-to-date so far for 2019. When the selloff of Jan/Feb 2018 occurred, I noted that it might be the beginning of the end, but I also knew that the bear market was yet to actually commence in earnest, because that particular selloff was based almost entirely on good underlying economic data (which sent bond yields too high). By the same type of logic, we can look at the underlying economic data for the recent rally--as well as the story being told by the bond markets--and understand that this time it looks very bad for the bulls.

Today we had the markets open at 2804 and quickly rise to 2813 as the worst-case scenario on Trump-Xi that the markets feared most was officially avoided. Yet near the end of trading, the market had nearly returned to its previous close of 2792, before rebounding a few points up. It's impossible to tell when exactly we'll be out of the woods for this late rally, but from a bear's perspective, it looks like it can't possibly have much steam left.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 2/17/19 at 1:07 pm to Doc Fenton

Meanwhile in the U.S. markets...

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 2/17/19 at 1:06 pm to LSUtoOmaha

I honestly can't figure out what's happening in China right now. We have both the Shanghai and Hong Kong markets bottoming just before Powell's remarks on 1/4, and then taking a steady climb up to last Wednesday, 2/13, before taking a small dip into the current weekend.

I had been expecting a move down after the week-long holiday for the Lunar New Year (2/4 - 2/8), but the markets rose through it. As I mentioned in a recent post, the China story has been a big deal so far in 2019. On the one hand, we are seeing markets become bullish on reports of massive monetary stimulus from the PBoC. On the other hand, we are not yet seeing that stimulus fully reflected in the underlying economy, with Chinese inflation for Jan 2019 coming in less than expected on Friday ( LINK), and Chinese M1 money supply for Jan 2019 was up just 0.4% y-o-y ( LINK), although there are some funky things going on with monthly dropoffs around the new year in recent years.

This would be ordinary enough for China, I suppose, except that there are also some crazy imbalances being reported in the real estate sector there, such as:

Nikkei Asian Review (2/13/2019): " China's housing glut casts pall over the economy" (A building binge leaves cities with 65 million empty apartments)

So these downgrades on 1/23 and 2/4 were occurring right in the middle of the stock market run-up. Weird.

I'm not ready to say that the Chinese government's stimulus operation has been a failure. They've seemingly had their backs to the wall several times before over the past 20 years, and they always seem to boost the economy back into growth. However, I also know that pattern can't last forever, and they are now dealing with small-player, local shadow banking leverage on a huge aggregated scale that they've never dealt with before. So can the Chinese government bailout the industrial and real estate sectors once again? Maybe, we'll have to see some positive inflation and money growth numbers before we'll know if that's happening.

I had been expecting a move down after the week-long holiday for the Lunar New Year (2/4 - 2/8), but the markets rose through it. As I mentioned in a recent post, the China story has been a big deal so far in 2019. On the one hand, we are seeing markets become bullish on reports of massive monetary stimulus from the PBoC. On the other hand, we are not yet seeing that stimulus fully reflected in the underlying economy, with Chinese inflation for Jan 2019 coming in less than expected on Friday ( LINK), and Chinese M1 money supply for Jan 2019 was up just 0.4% y-o-y ( LINK), although there are some funky things going on with monthly dropoffs around the new year in recent years.

This would be ordinary enough for China, I suppose, except that there are also some crazy imbalances being reported in the real estate sector there, such as:

Nikkei Asian Review (2/13/2019): " China's housing glut casts pall over the economy" (A building binge leaves cities with 65 million empty apartments)

quote:

Funding problems for some developers

Investors are also growing jittery about the property sector. While the outlook for top developers like Country Garden and China Vanke remains stable, the bond market is flashing warning signs about debt held by many smaller Chinese property groups.

Four of them now carry a "CCC" rating from S&P Global Ratings -- deep into junk territory. Such ratings signal that companies are "vulnerable" and may not survive a slide in business conditions. The credit agency only rates 13 companies in the Asia-Pacific region this low out of the roughly 1,120 companies that it evaluates.

Hong Kong-headquartered Guorui Properties is one of them. The company was downgraded two notches to "CCC" by S&P on Feb. 4, a move reflecting "uncertainty over the company's refinancing plan for its imminent debt maturities" -- a warning that the midsized developer could default on its debts. Another developer, Yida China Holdings, was downgraded at the end of January to "CCC+," with analysts raising concerns that the company's "capital structure, with limited cash balance and weak liquidity, is unsustainable in the longer run and is vulnerable to adverse market conditions." The Shanghai-based business park operator has not paid the annual dividends it declared last March.

Similarly, Moody's on Jan. 23 took action on Jiayuan International Group, dragging its rating down two notches to "Caa1" with a negative outlook. The ratings agency is concerned that a recent sharp fall in share price coupled with an unstable ownership structure could "undermine investor confidence [and] increase refinancing risks."

So these downgrades on 1/23 and 2/4 were occurring right in the middle of the stock market run-up. Weird.

I'm not ready to say that the Chinese government's stimulus operation has been a failure. They've seemingly had their backs to the wall several times before over the past 20 years, and they always seem to boost the economy back into growth. However, I also know that pattern can't last forever, and they are now dealing with small-player, local shadow banking leverage on a huge aggregated scale that they've never dealt with before. So can the Chinese government bailout the industrial and real estate sectors once again? Maybe, we'll have to see some positive inflation and money growth numbers before we'll know if that's happening.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 2/15/19 at 7:13 am to LSUtoOmaha

Also... and this might be slightly inappropriate for this board, but... GAMEDAY BITCHES!!

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 2/14/19 at 6:14 pm to LSUtoOmaha

quote:

buybacks for life

I wonder if we can get pioneerbasketball from the SEC Rant to make us a Team Buybacks bunchie avatar.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 2/14/19 at 12:38 am to buckeye_vol

Well, hot damn. You are correct.

I may have had a fleeting thought about this before, but I never really worked through the implications, because for some reason I assumed the difference would never be big enough to matter that much. But it really does if Q1 growth and Q4 growth from the previous year are slow.

And that's only if you count rounding up. It gets a lot higher if you adhere to a strict >= 3.0% approach.

I was wrong. Thanks for the explanation.

:cheers:

I may have had a fleeting thought about this before, but I never really worked through the implications, because for some reason I assumed the difference would never be big enough to matter that much. But it really does if Q1 growth and Q4 growth from the previous year are slow.

quote:

So using the government’s method though, would required a 3.64% growth.

And that's only if you count rounding up. It gets a lot higher if you adhere to a strict >= 3.0% approach.

I was wrong. Thanks for the explanation.

:cheers:

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 2/13/19 at 7:43 pm to Doc Fenton

To get back on the subject of what's been driving the 4Q drops in the market (from 10/3/18 to 12/24/18) and the post-Christmas rally (from 12/24/18 to present), there have been a few interesting charts I've seen in recent days.

What we've been hearing from a lot of bulls in the financial media is that the December selloff was caused by investors getting jittery over the federal government budget standoff and U.S.-China trade relations. But this story doesn't really make a lot of sense.

The big story that gets less coverage is the recent consensus from EM investors that the Chinese markets have bottomed, and that PBoC stimulus was overwhelming and has already saved the day. I'm skeptical of that, but it's certainly been a huge factor so far in 2019. Additionally, of course, we have the loosening expectations on FRB monetary policy. Taken together, the PBoC and FRB have driven the post-Christmas rally.

Note that corporate earnings projections have not driven the rally. As of a few days ago, S&P 500 operating earnings growth for the 2Q of 2019 have now dipped below inflation expectations. Wall Street is selling investors on the idea that earnings growth will return stronger in the 4Q, but those projections are already more than halfway to zero relative to where they were in early October 2018.

And as I said for the alleged miracle rebound of the Chinese economy, I'm skeptical. According to FactSet ( LINK), revenue growth projections for S&P 500 firms with over 50% of sales outside the U.S. aren't looking very healthy.

Insight/2019/02.2019/02.11.2019_ToW1/EstimatedEarnings+RevGrowthCY2019.png?width=1368&name=EstimatedEarnings+RevGrowthCY2019.png)

Some of that is attributable to the current EU recession, but much of it (especially when it comes to corporations looking for high sales growth) is Chinese. Now I don't want to base too much of my analysis on China, because it's opaque, and because I don't ultimately know what's going to happen with U.S.-China trade negotiations (which seem to be getting suspended indefinitely in a lengthy state of limbo), and because I base my analysis mostly on domestic evidence. But the China narrative is essential to understanding the past two months, and I think most of it points to something happening that goes well beyond the current trade negotiations.

Anyway, as of the close of trading today, we now stand 17.3% above the intraday bottom from Christmas Eve (just 51 days earlier), but we are also still 6.4% below the peak from late September. My bet is that we have still yet to see the majority of the fallout from continually falling corporate revenue projections, because that fallout has been delayed (but not eliminated) by central banks.

What we've been hearing from a lot of bulls in the financial media is that the December selloff was caused by investors getting jittery over the federal government budget standoff and U.S.-China trade relations. But this story doesn't really make a lot of sense.

The big story that gets less coverage is the recent consensus from EM investors that the Chinese markets have bottomed, and that PBoC stimulus was overwhelming and has already saved the day. I'm skeptical of that, but it's certainly been a huge factor so far in 2019. Additionally, of course, we have the loosening expectations on FRB monetary policy. Taken together, the PBoC and FRB have driven the post-Christmas rally.

Note that corporate earnings projections have not driven the rally. As of a few days ago, S&P 500 operating earnings growth for the 2Q of 2019 have now dipped below inflation expectations. Wall Street is selling investors on the idea that earnings growth will return stronger in the 4Q, but those projections are already more than halfway to zero relative to where they were in early October 2018.

And as I said for the alleged miracle rebound of the Chinese economy, I'm skeptical. According to FactSet ( LINK), revenue growth projections for S&P 500 firms with over 50% of sales outside the U.S. aren't looking very healthy.

Insight/2019/02.2019/02.11.2019_ToW1/EstimatedEarnings+RevGrowthCY2019.png?width=1368&name=EstimatedEarnings+RevGrowthCY2019.png)

Some of that is attributable to the current EU recession, but much of it (especially when it comes to corporations looking for high sales growth) is Chinese. Now I don't want to base too much of my analysis on China, because it's opaque, and because I don't ultimately know what's going to happen with U.S.-China trade negotiations (which seem to be getting suspended indefinitely in a lengthy state of limbo), and because I base my analysis mostly on domestic evidence. But the China narrative is essential to understanding the past two months, and I think most of it points to something happening that goes well beyond the current trade negotiations.

Anyway, as of the close of trading today, we now stand 17.3% above the intraday bottom from Christmas Eve (just 51 days earlier), but we are also still 6.4% below the peak from late September. My bet is that we have still yet to see the majority of the fallout from continually falling corporate revenue projections, because that fallout has been delayed (but not eliminated) by central banks.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 2/13/19 at 6:41 pm to buckeye_vol

You might need to check your math. From the latest spreadsheet that I downloaded from the BEA at Commerce, I calculate that only 2.2% annualized real GDP growth for the 4Q is required to achieve a 3.0% figure for all of 2018, assuming no other revisions of course.

Also, while I love dumping on Krugman and his political hackery as much as anyone, his recent remarks (see at YouTube), at least on the topic of recession, were fairly measured. He only said that the odds of recession within the next couple of years were better than even. From Canada's Financial Post ( LINK):

Also, while I love dumping on Krugman and his political hackery as much as anyone, his recent remarks (see at YouTube), at least on the topic of recession, were fairly measured. He only said that the odds of recession within the next couple of years were better than even. From Canada's Financial Post ( LINK):

quote:

Krugman isn’t alone in seeing a gloomy outlook for the world’s biggest economy. U.S. chief financial officers in a Duke University survey published in December overwhelmingly said they expect a recession within two years.

“I wouldn’t be as definitive, but it seems pretty likely,” Krugman said.

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 2/12/19 at 9:31 pm to LSUtoOmaha

Dammit!! :angry:

re: There are some major issues lurking in the US financial markets

Posted by Doc Fenton on 2/8/19 at 11:48 am to wutangfinancial

quote:

Check out industrial production last quarter, all negative postings. Their yield curve is also inverted out to 10 years on the term structure and the 30s are yielding 1%.

Yeah. Bill Gross announced his retirement just a few days ago, and if I'm not mistaken, in part it was hastened by the poor performance of his last big strategic play--shorting the German bund and going long U.S. bonds (betting that the spread between the two will narrow).

Eventually, though, I think his wisdom will prove correct here... although of course that doesn't matter much if the timing is wrong.

quote:

I will say that the Fed isn't out of options. They can drop rates to zero at the signs of economic contraction

Yep. I sometimes type a lot of stuff quickly and make off-the-cuff remarks that are overbroad, and don't quite capture the context of my intended message.

When I claimed that the Fed is out of ammunition, I meant that in the context of having ammunition to prevent the onset of a bear market, since at some juncture, we reach a tipping point where dovish actions by the Fed signals an economic contraction, and thus will tend to have the bad-economic-signals bear effects start to outweigh the looser-monetary-policy bull effects, in terms of moving the market up or down in short-term response.

If and when signs of economic contraction arrive, then yes, the Fed will take consequential actions that have significant effects on the market (although they will have less room to maneuver than they did in 2001 and 2008). I'm just saying that we may have reached the point where the Fed can only mitigate a bear market, not prevent it from occurring.

:cheers:

Popular

5

5